Project X #12 ~ Stock Price Prediction with LSTMs: A Step-by-Step Guide to Forecasting the Market

Learn how to predict stock prices using LSTM neural networks in Tensorflow. This project covers data preprocessing, model training, and real-time forecasting.

The stock market is always changing, with prices going up and down based on all kinds of factors. Things like economic reports, how well a company is doing, what investors are feeling, and even major world events can all have an impact.

For most of our lives, we’ve tried to predict stock prices using historical trends, technical analysis, and different forecasting models. Or just hiring a financial advisor and trusting they know the right calls…

Thank god nowadays machine learning has made big advancements in this area. One of the most promising approaches is using deep learning models like Long Short-Term Memory (LSTM) networks.

LSTM is a special type of neural network built to work with sequential data, meaning really this just means it’s great for time-series forecasting.

This is the 12th edition which officially marks one year of Project X! My mission for Project X? To empower you with the tools and knowledge to unleash your creativity and build impactful, real-world solutions using Python.

Welcome to Project X – where dreams meet code! Dive into creativity as I guide you through the creation of a captivating project, step by step, in each monthly edition. From conceptualization to execution. Join premium today!

Oh, and unlike traditional machine learning models, which often struggle to remember past patterns over long periods, LSTMs are actually made to recognize important trends and relationships in data that unfold over time.

This makes them really useful for predicting stock prices since historical price movements can offer key insights into what might happen next.

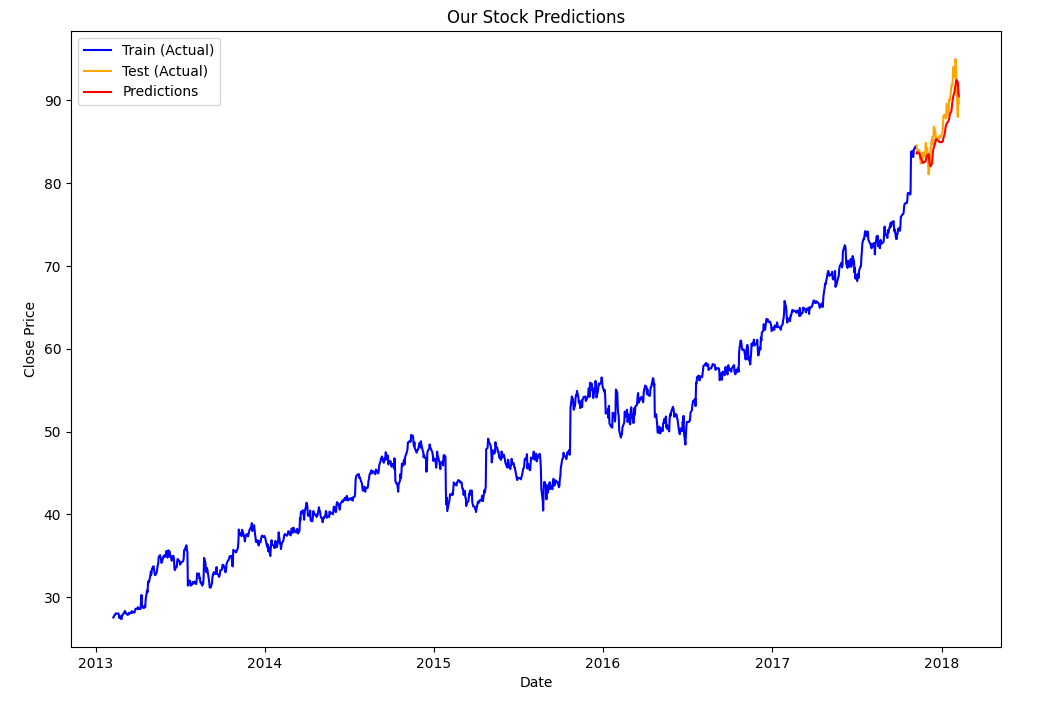

In this edition of Project X, I’ll go step by step through the process of building an LSTM model for stock price prediction. Together we’ll start with preparing and cleaning the data, then move on to exploring the data, selecting key features, building the model, training it, testing its accuracy, and finally visualizing the results.

By the end, you’ll have a solid understanding of how LSTM networks can be used to predict stock prices based on historical data. And yes, we are going to use slightly older data so we can actually check how well the model has preformed over time.

I’ll link the previous Project X here where we built a Machine Learning Pipeline for future reference.

👉Premium readers can recommend projects at the bottom.

👉 Access my Source Code for all Projects at the bottom.

👉 Gain access to my full article archive.

These projects take a lot of time and resources for me to craft in a way that I can present them and share them for you all.

Thank you for allowing me to do work that I find meaningful. This is my full-time job so I hope you will support me!

👉 If you value projects like this one, please leave it a ❤️ and share it with others. This helps more people discover these projects, which helps me out!

Let’s start predicting the future!

P.S - I shouldn’t have to say this, but this is not financial advice…

🧰 Importing the Right Tools for the Job

Before you can start analyzing stock market data and building a predictive model, you need to load a few essential Python libraries.

Keep reading with a 7-day free trial

Subscribe to The Nerd Nook to keep reading this post and get 7 days of free access to the full post archives.